China’s Aquaculture Armada Is Coming—And the West Isn’t Ready

For years, I’ve argued that the development of domestic aquaculture should be an important element of a national food security strategy – generally, without moving the needle an inch. It simply wasn’t an argument that resonated in political circles and certainly had no impact on investors.

There has been a lot of news coming out of China recently which make it clear that offshore aquaculture, especially in deep-sea vessels, is the next frontier. China gets it. China sees the opportunity, and is heavily funding the solution.

The West doesn’t. The West can scarcely believe it is even possible. That divergence isn’t just frustrating—it’s dangerous.

Why China Thinks About Food Security Differently

The memory of the Great Famine of 1959-61 is baked into the consciousness of China’s leadership. Xi Jinping was a child during the famine. Other senior leaders were toddlers or infants, raised in homes where hunger was not theoretical. Even those born later were educated in a system where food insecurity is taught as a regime-threatening risk. The famine killed an estimated 30 million people and shattered public trust. Since then, food has been treated not as a commodity but as a cornerstone of national security.

Contrast this with the West. To the best of my knowledge, no senior Western political figure has experienced systemic hunger. In the U.S., EU, and Canada, food is often framed through the lenses of trade, environment, or rural livelihoods. Strategic urgency is absent. Leaders trust global supply chains and diversified imports. There’s no existential fear underpinning Western food policy.

What They’re Building at Sea

An incomplete list of Chinese vessel projects.

China is scaling deep-sea aquaculture with a seriousness that should worry everyone else. It’s not speculative; it’s industrial. State-owned yards are delivering 150,000-tonne offshore aquaculture vessels. These projects are classified under "strategic emerging industries" — putting them in the same category as semiconductors and EVs. Massive state capital is flowing in. Permitting is streamlined. Demonstration vessels like the Guoxin-1 are already operational.

Meanwhile, Western innovators are stuck in limbo—struggling for grants, battered by permitting delays, and ignored by risk-averse investors. No equivalent industrial policy exists in the West to match China’s coordinated effort.

The Coming Shock

Right now, China is solving its own protein-security problem. But history tells us what happens next. Consider:

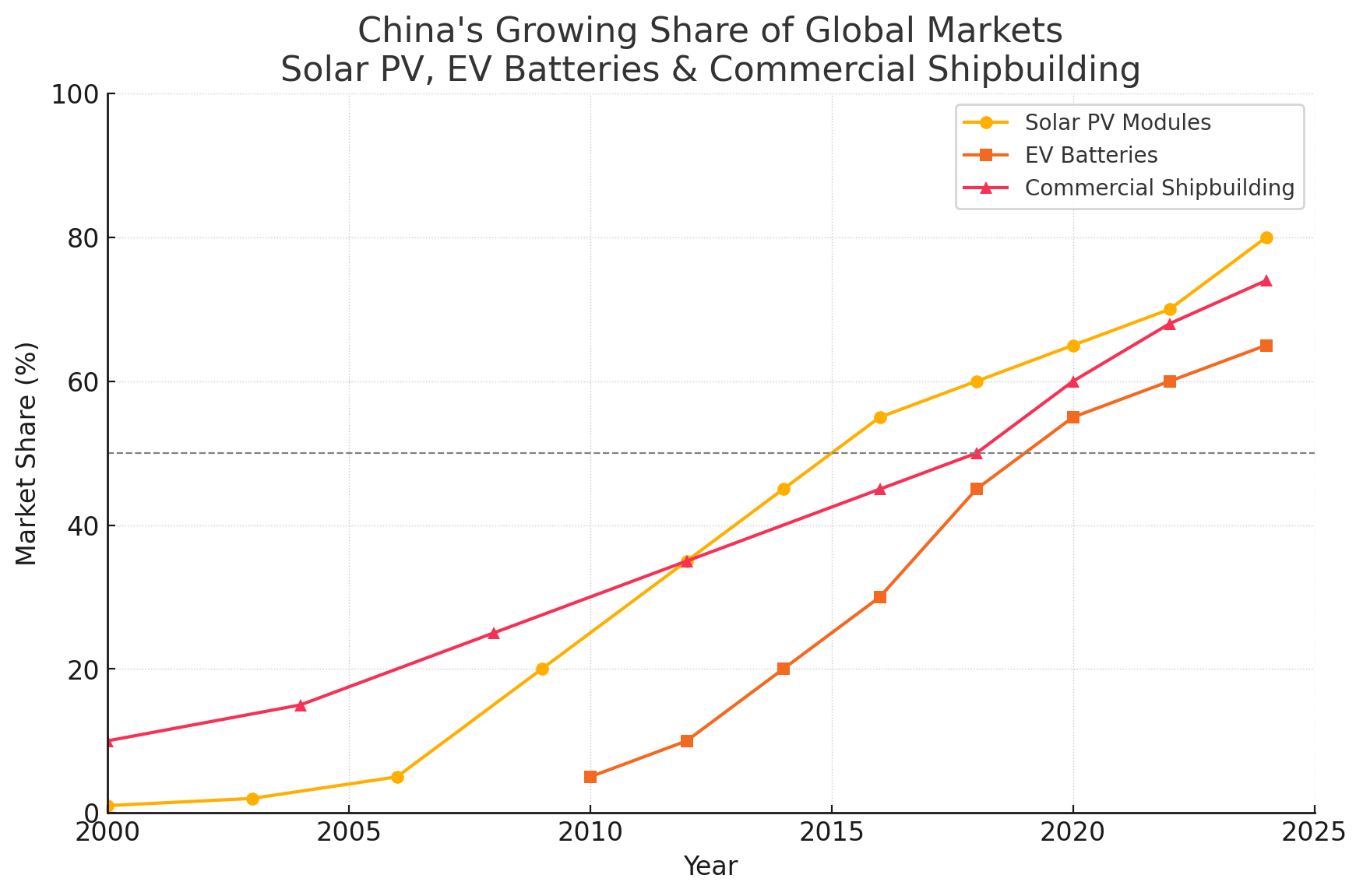

1. Solar Panels: Initially built to cut coal imports, China flooded its own market with subsidized panels. Then it flooded ours. By 2024, Chinese firms control over 60% of global PV module supply. Western solar industries were undercut and, in many cases, obliterated.

2. EV Batteries: Faced with oil dependence, China built a colossal battery and EV ecosystem. State support created giants like CATL and BYD. Today, China owns over 60% of the global battery supply and is exporting aggressively.

3. Shipbuilding: Worried about foreign dependence for naval hulls, China merged its yards, deployed credit, and dominated global commercial shipbuilding. It now commands over half of global new-build tonnage.

Rapid development in strategic emerging industries

Offshore aquaculture is next. Once domestic demand is met, Chinese yards and agritech firms will export turnkey fish-farming systems at a scale and price Western producers cannot match. This isn’t speculative. It’s the playbook. With EV batteries, the Chinese took their industry from a market share in the single digits to more than 60% in less than 15 years.

Ignore This at Your Peril

Offshore aquaculture isn’t a curiosity. It’s fast becoming a pillar of China’s food-security doctrine. The vessels are real. The subsidies are flowing. The strategic logic is coherent. They have identified offshore aquaculture as an SEI – Strategic Emerging Industry – just as they did with solar panels, EV batteries and ship building. If we don’t wake up and support the development of aquaculture systems that reduce cost, can scale significantly in a low-carbon footprint manner, and increase the amount of seafood we produce, the Chinese will do it for us and will control the supply chain even more than they do now.

If Western governments and investors don’t take this seriously—if they continue to treat food security as a niche or non-urgent issue—they’ll find themselves importing protein from ships they didn’t build, under rules they didn’t write, owned by a country that never forgot what hunger feels like.

The salmon industry should take note. So should anyone who still thinks offshore aquaculture is too far-fetched to matter. Because while the West dithers, China is building blue grain barns—and they won’t stop at their own shores.